It has often appeared that the desire of the regulatory board for auditors to protect its members overshadows its responsibility to inform the public about dodgy auditors.

The “Big Four” audit firms – Deloitte, EY, KPMG and PwC – are regularly implicated in audit failures at both listed private companies and public entities. These failures have devastating public costs; just ask the pensioners and investors who lost more than R200-billion when Steinhoff collapsed, or the South Africans who are being asked to fork out more money to bail out South African Airways.

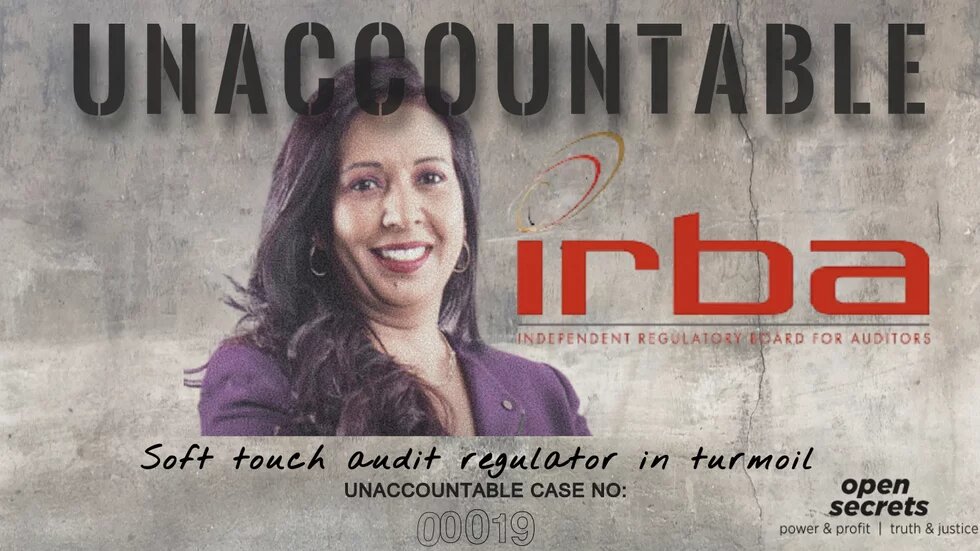

The Independent Regulatory Board for Auditors (IRBA) is the regulator tasked with holding auditors to account in cases of misconduct, unlawful or unethical behaviour. As detailed in Open Secrets’ Corporations and Economic Crime Report (CECR): The Auditors – the IRBA has repeatedly failed to live up to this task. The evidence shows that the IRBA does not have sufficient powers to be an effective regulator. It has also often failed to use the powers it does have to effectively deter unlawful conduct by registered auditors.

IRBA – failing to fulfil a crucial mandate

Auditors are among the professionals that fail to fulfil their professional and legal duties, and there is evidence that many have been knowingly or negligently complicit in serious economic crimes. Even when their conduct has not been criminal, they have failed to fulfil the public’s legitimate expectation that auditors be independent and exercise professional scepticism when signing off on financial statements, rather than uncritically deferring to management. This is not the IRBA’s fault alone, of course. However, it must answer to the public as one of several regulators in the financial sector that has failed to adequately ensure ethical and lawful conduct in the profession it regulates.

On its website, the IRBA states that its mandate is to contribute to “an ethical, value-driven financial sector that encourages investment, creates confidence in the financial markets and promotes sound practices”. Despite this, on the rare occasion that auditors have been hauled before the IRBA, a slap on the wrist behind closed doors has been the usual outcome. A crucial way in which the IRBA is supposed to fulfil its mandate of building an ethical financial sector that creates public confidence, is by “monitoring registered auditors’ compliance with professional standards”, and “investigating and taking appropriate action against registered auditors in respect of improper conduct”. Where it fails to do so, a key deterrent against improper and unethical conduct is lost, and public trust is further eroded.

***********************